FedNow & Real-Time

Payments

Solutions

Online integrated Origination, Sending, Receiving and Recordation of all Good Funds Transfers.

"All participants receive instant real-time electronic notifications. Use our online Payment Gateway interface or integrate your in-house system with our API"

More infoCredit Card Processing

Retail Face-to-Face

Mail Order Telephone Order

eCommerce Internet Sales

eMail Invoicing

Check Processing

Online Reporting with Images

Stop Going to the Bank

Next Day Funding

Check 21 - Remotely Create Checks

Electronic Check

Mobile FedNow® Compatibility & Interoperability with RTP® Real-Time Instant Payments

Mobile FedNow® Compatibility with RTP® Real-Time Payments

Both Mobile FedNow® and RTP® (Real-Time Payments) offer instant fund transfers, but they operate on different networks. While RTP® is controlled by The Clearing House, FedNow® is built by the Federal Reserve, making it more accessible to a wider range of financial institutions.

Businesses using Mobile FedNow® can seamlessly interact with the RTP® network, ensuring greater interoperability across real-time payment systems. This compatibility provides businesses and individuals with broader financial access, reducing restrictions on which banks can participate in instant payments.

Key Benefits:

✅ Greater accessibility

than RTP®, supporting more banks

✅ Seamless

real-time fund transfers across both networks

✅

Lower transaction costs compared to RTP® fees

✅

Reliable government-backed infrastructure

✅

More inclusive financial access for businesses and

individuals

How Mobile FedNow® & RTP® Work Together

With the rise of Real-time Payments, both Mobile FedNow® and RTP® (Real-Time Payments) are leading the way in instant, secure, and efficient financial transactions. While both systems are designed to facilitate real-time bank-to-bank transfers, businesses and financial institutions need to understand how they work together, their compatibility, and their unique advantages.

1) How Mobile FedNow® & RTP® Work Together

Mobile FedNow® is developed by the Federal Reserve, while RTP® is operated by The Clearing House. Both payment systems aim to enable instant, secure, and irrevocable transactions between financial institutions. While RTP® has been in operation since 2017 and is widely used by larger banks, FedNow® expands real-time payment accessibility to smaller financial institutions, ensuring broader adoption across the industry.

2) Key Differences & Interoperability

While both FedNow® and RTP® offer instant payments, 24/7 transaction processing, and enhanced security, their interoperability depends on bank participation and network infrastructure. Businesses can leverage Mobile FedNow® to process payments even if their recipient’s bank is on RTP®, ensuring a seamless, real-time payment experience across both platforms.

FedNow® expands access to a wider range of financial institutions, meaning businesses using Mobile FedNow® can interact with RTP® participants, creating broader compatibility for real-time payments. This ensures that companies can send and receive funds instantly, regardless of whether their financial partner is using FedNow® or RTP®.

3) Benefits of FedNow® & RTP® Interoperability

By enabling Mobile FedNow® to work alongside RTP®, businesses and financial institutions benefit from:

✅ Expanded bank access—more

financial institutions can process real-time payments

✅

Seamless transactions—businesses can send & receive

payments across both networks

✅ Instant fund

transfers—no delays, 24/7 availability for businesses &

consumers

✅ Secure & fraud-resistant payments—irrevocable

transactions with advanced protection

✅ Lower

transaction costs—no credit card or third-party processing

fees

4) The Future of Real-Time Payments with Mobile FedNow® & RTP®

The interoperability between Mobile FedNow® and RTP® is paving the way for a faster, more inclusive digital payment ecosystem. As more financial institutions adopt real-time payment solutions, businesses will benefit from increased liquidity, reduced transaction fees, and improved cash flow management.

Optimize Your Payment Strategy with Mobile FedNow® & RTP®

Whether you're a business owner, financial institution, or individual looking for faster transactions, Mobile FedNow® and RTP® together provide the most advanced real-time payment solutions available today. Ensure your business stays ahead in the digital economy—embrace real-time payments with FedNow® and RTP® today!Creation Request for Payment Bank File

Enhance Your Mobile FedNow Real-Time Payments Requests with FedNow’s ISO 20022 Messaging

Streamline Payments with Advanced Request for Payment Options:

Harness the power of FedNow's Request for Payment system to transform how you manage invoices and remittances. Our platform supports diverse data integration options, allowing payees to incorporate detailed invoice data directly within the RfP message or link to a comprehensive Merchant Page.

Flexible Invoice Details with ISO 20022 Messaging:

Leverage the flexibility of ISO 20022 messaging standards in our RfP system. You can choose to display crucial payment details directly in the message with a concise 140-character description, or through a dynamic "Hyper-Link" leading to a detailed Merchant Page. This Merchant Page can be hosted either on your website or TodayPayments.com/HostedPaymentPage.html through our seamless integration solution.

Customizable Merchant Pages for Enhanced Customer Experience:

Create a Merchant Page that not only details all the MIDs you own but also presents these options attractively to your customers through the RfP. This customization ensures that whether your payer opts for Real-Time Payment, Same-Day ACH, or Card transactions, they can easily navigate and complete their payments through a simple click on the hyperlink provided on your Merchant Page.

Call us today and receive the .csv or .xml FedNow® or Request for Payment (RfP) file you need—all during your very first phone call! We guarantee that our comprehensive reports integrate flawlessly with your bank or credit union. As pioneers in recognizing the benefits of RequestForPayment.com, we have stayed years ahead of our competitors. Although we are not a bank, our role as an "Accounting System" within the Open Banking ecosystem enables us to work with billers to create effective RfP files that seamlessly upload to the biller's online banking platform. U.S. companies rely on our expertise to learn how to deliver the RfP message directly to their bank with precision.

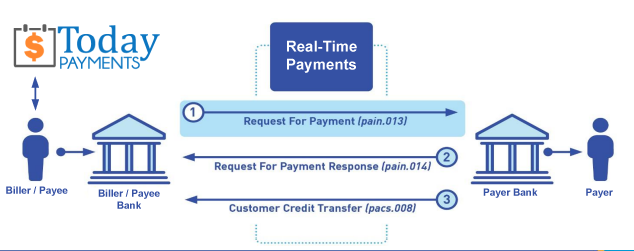

Our advanced solution, Today Payments' ISO 20022 Payment Initiation (PAIN.013), demonstrates how to create a Real-Time Payments Request for Payment file that sends a clear message from the creditor (payee) to its bank. Most financial institutions support the import of messaging and batch files for both FedNow® and Real-Time Payments (RtP), ensuring smooth processing. Once the file is correctly uploaded, the creditor’s bank processes the payment through a secure "Payment Hub"—with The Clearing House serving as the RtP Hub—and relays the message to the debtor's (payer's) bank. This streamlined approach not only accelerates transaction processing but also enhances transparency and reliability for all parties involved.

... easily create Real-Time Payments RfP files. No risk. Test with your bank and delete "test" files before APPROVAL on your Bank's Online Payments Platform.

Today Payments is a leader in the evolution of immediate payments. We were years ahead of competitors recognizing the benefits of Same-Day ACH

and Real-Time Payments funding. Our business clients receive faster

availability of funds on deposited items and instant notification of

items presented for deposit all based on real-time activity.

Dedicated to providing superior customer service and

industry-leading technology.

Contact Us for Request For Payment payment processing